HIGHLIGHTS:

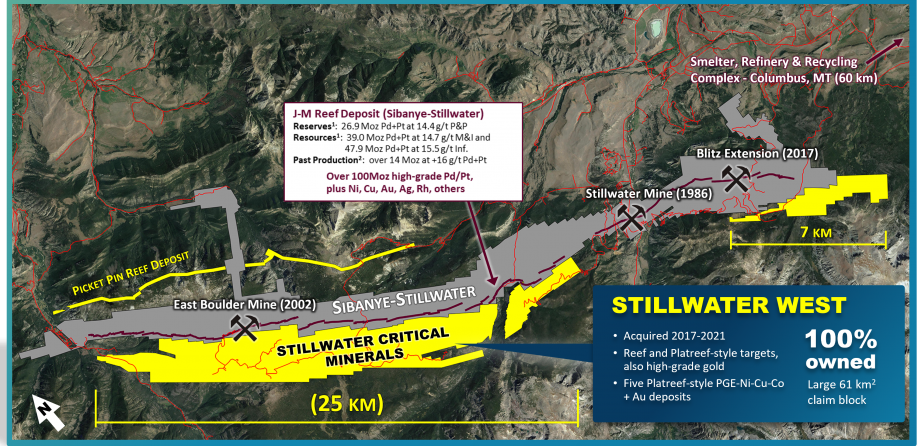

- 100%-owned, large, brownfields project in Montana’s Stillwater District, one of the world’s largest and highest-grade PGE-Ni-Cu regions adjacent to high-grade Sibanye-Stillwater’s PGE Mines¹ with over 14Moz past Pd+Pt production2

- In 2023, the Company announced a 9.99% strategic equity investment by Glencore

- Results from 2023 drilling and exploration campaign are expected in early Q1 2024

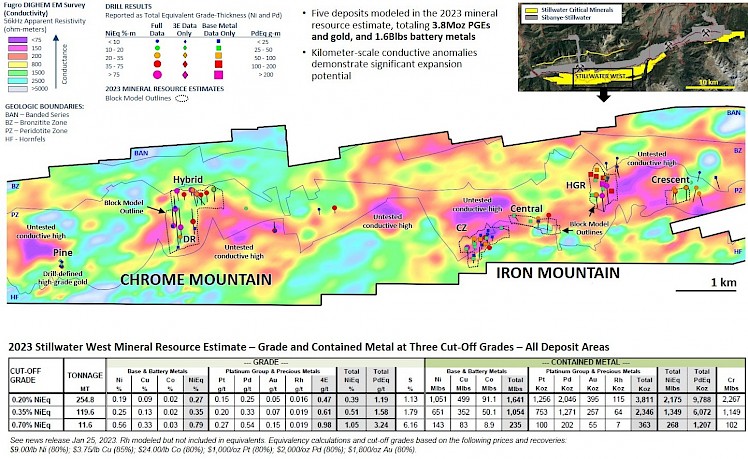

- 2023 mineral resource estimate update expanded the inaugural resource by 62% and defined 1.6 billion pounds (“Blbs”) of nickel, copper and cobalt and 3.8 million ounces (“Moz”) palladium, platinum, rhodium, and gold (“4E”) in a constrained model totaling 255 million tonnes (“Mt”) at an average grade of 0.39% total estimated recovered NiEq (or 1.19 g/t Palladium Equivalent “PdEq”). See news release.

- The selective mining high-grade component yielded 11.6Mt at 1.05% Total NiEq (or 3.24 g/t Total PdEq) as 0.56% Ni, 0.33% Cu, 0.03% Co with 0.54 g/t Pd, 0.27 g/t Pt, 0.15 g/t Au and 0.019 g/t Rh. Expansion of this high-grade component results from the addition of high-grade mineralization encountered in the 2021 drill campaign.

- The 2023 Resource is contained within five deposits in the 9-kilometer central area of the project, all of which are open along strike and at depth. Multi-kilometer scale geophysical targets and metal-in-soil anomalies indicate excellent expansion potential. Untested anomalies and earlier stage targets extend across much of the 32-kilometer-long Stillwater West project.

- The Stillwater District has a rich mining history for PGEs, Ni, Cu, Cr, and other commodities

- Stillwater West features an extensive database –– including almost 12,000 meters of historical core –– to which Stillwater Critical Minerals is applying modern geological models developed in South Africa at Ivanhoe’s Platreef and Anglo American’s Mogalakwena mines

- Existing road access and power infrastructure with three operating mines

_____________________________________________________________________________________________________

OVERVIEW

Stillwater Critical Minerals is advancing the Stillwater West PGE-Ni-Cu-Co + Au project towards becoming a world-class source of low-carbon, sulphide-hosted nickel, copper, and cobalt, critical to the electrification movement, as well as key catalytic metals including platinum, palladium and rhodium used in catalytic converters, fuel cells, and the production of green hydrogen.The project consists of 14 multi-kilometer-scale exploration target areas along a 32 km strike length adjoining and adjacent to Sibanye-Stillwater’s high-grade Stillwater mines along the JM Reef in the Stillwater Igneous Complex of Montana, USA. Located in one of the top regions in the world for PGE-Ni-Cu mineralization, the Stillwater mines are the highest-grade major PGE project in the world and the largest outside South Africa and Russia. In June 2017, one month after South African producer Sibanye announced the completed takeover of Stillwater Mining company for USD 2.2 billion, Stillwater Critical Minerals announced the acquisition of Stillwater West project acquisition deal, which positioned the Company as the second largest landholder in the district. In addition to the land package, the Stillwater West acquisition included an extensive historic database of soil and rock geochemistry, geophysical surveys, geologic mapping, and historic drilling with nearly 12,000 metres of preserved core.

The J-M Reef, and other PGE-enriched sulphide horizons in the Stillwater Complex, share many similarities with the highly prolific Merensky and UG2 Reefs in the Bushveld Complex. SWCM’s work in the lower Stillwater Complex has demonstrated the presence of large-scale disseminated and high-sulphide battery metals and PGE mineralization, similar to the Platreef in the Bushveld Complex. Drill campaigns by the Company, complemented by a substantial historic drill database, have delineated five deposits of Platreef-style mineralization across a core 12-kilometer span of the project, all of which are open for expansion into adjacent targets. Multiple earlier-stage Platreef-style and reef-type targets are also being advanced across the remainder of the 32-kilometer length of the project based on strong correlations seen in soil and rock geochemistry, geophysical surveys, geologic mapping, and drilling.

In January 2023, Stillwater CM announced a 62% expansion of its inaugural mineral resource estimate on the Stillwater West project consisting of 1.6 billion pounds (“Blbs”) of nickel, copper and cobalt and 3.8 million ounces (“Moz”) palladium, platinum, rhodium, and gold (“4E”) in a constrained model totaling 255 million tonnes (“Mt”) at an average grade of 0.39% total estimated recovered NiEq (or 1.19 g/t Palladium Equivalent “PdEq”). The estimate incorporates starter deposits at five target areas within the central area of the project which covers just 8.7 kilometers (“km”) of the overall 32km strike length. The Company’s 2021 drill campaign was designed based on the demonstrated strong correlation of drill-defined mineralization with both geophysical and geochemical anomalies with the goal of resource expansion and enhancement.

Notes: 1) In-Pit Inferred Mineral Resources are reported at a base case cut-off grade of 0.20% NiEq. Values in this table reported above and below the cut-off grades are only presented to show the sensitivity of the block model estimates to the selection of cut-off grade. Equivalent grade and contained metal calculations do not include Rhodium values; 2) All figures are rounded to reflect the relative accuracy of the estimate. Totals may not add or calculate exactly due to rounding.

The current Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured. However, based on the current knowledge of the deposits, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

_____________________________________________________________________________________________________

¹In-pit Mineral Resources are reported at a base case cut-off grade of 0.20% NiEq. Pit optimization and Cut-off grades are based on metal prices of $9.00/lb Ni, $3.75/lb Cu, $24.00/lb Co, $1,000/oz Pt, $2,000/oz Pd and $1,800/oz Au, assumed metal recoveries of 80% for Ni, 85% for copper, 80% for Co, Pt, Pd and Au, a mining cost of US$2.50/t rock and processing and G&A cost of US$18.00/t mineralized material. The current Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred Resources in this Mineral Resource Estimate are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as Indicated or Measured. However, based on the current knowledge of the deposits, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

2References to adjoining properties are for illustrative purposes only and are not necessarily indicative of the exploration potential, extent or nature of mineralization or potential future results of the Company’s projects.

J-M Reef Deposit (Sibanye-Stillwater)

Reserves: 25.6 Moz P&P at 13.4 g/t Pd and 3.8 g/t Pt

Resources: 34.1 Moz M&I at 12.8 g/t Pd and 3.6 g/t Pt

45.9 Moz Inf at 12.75 g/t Pd and 3.6 g/t Pt.

Mineral Resources based on Sibanye-Stillwater’s 2018 Mineral Resources and Mineral Reserves Report. These resource and reserve estimates were prepared by Sibanye-Stillwater based on the South African Code for the Reporting of Mineral Asset Valuation and the South African Code for the Reporting of Mineral Asset Valuation, which differ from the requirements of NI 43-101 and SEC Industry Guide 7. The Company does not have access to such project or underlying information and has not independently verified any of the scientific, technical or exploration information related to such third-party project.

3Based on publicly disclosed production statistics of Sibanye-Stillwater including most recent CPR.

*References

Mineralization identified on adjacent properties does not necessarily indicate that mineralization will be identified on Group Ten Metals projects.

Report on Montana Platinum Group Metal Mineral Assets of Sibanye-Stillwater, November 2017, Measured and Indicated Resources of 57.2 million tonnes grading 17.0 g/t Pt+Pd containing 31.3 million ounces and 92.5 million tonnes grading 16.6 g/t containing 49.4 million ounces.

Public production records from Stillwater Mining Company from 1992 to present.

Magmatic Ore Deposits in Layered Intrusions—Descriptive Model for Reef-Type PGE and Contact-Type Cu-Ni-PGE Deposits, Michael Zientek, USGS Open-File Report 201